Harmonia Pitch Deck 2025

We are building the core digital infrastructure for the UK mental health workforce.

A unified, automated platform connecting jobs, volunteering, placements, training, CPD and events — supported by verification, AI-driven content tools and sector data intelligence.

With an expert-led MVP build underway for June 2026 launch, we're seeking £1m to accelerate platform development and national scale, targeting £11.5m ARR within three years from a conservative £45.9m serviceable market.

Our Vision

Harmonia Careers is building the UK’s first AI-enabled, verification-led workforce platform dedicated to mental health professionals.

We unify jobs, career pathways, CPD and workforce intelligence into one national infrastructure – replacing fragmented systems, manual verification and generic recruitment tools with a platform built for clinical reality.

This isn’t just a careers platform. It’s a stake in the future of the UK’s mental health workforce.

The Problem

The UK’s mental health workforce is growing fast – but the systems around it haven’t. Over 30,000 vacancies exist at any given time, yet there is no national infrastructure to support practitioners, training providers or employers navigating this growth.

- Careers are fragmented.

- Verification is slow and manual across dozens of registers.

- Employers rely on generic job boards not built for the sector.

- Workforce data is scattered and unstructured.

The Solution

We are building the UK's first verification-led, AI-powered workforce platform built specifically for the mental health sector. Key features:

- Automated PSA verification – the UK’s first pre-verified mental health talent pool

- AI taxonomy & matching engine – sector-specific, not generic

- Purpose-built employer tools – dashboards, analytics and compliance features

- Structured practitioner journeys – from student to senior clinician

- Scalable, SEO-optimised national platform architecture

Market Opportunity

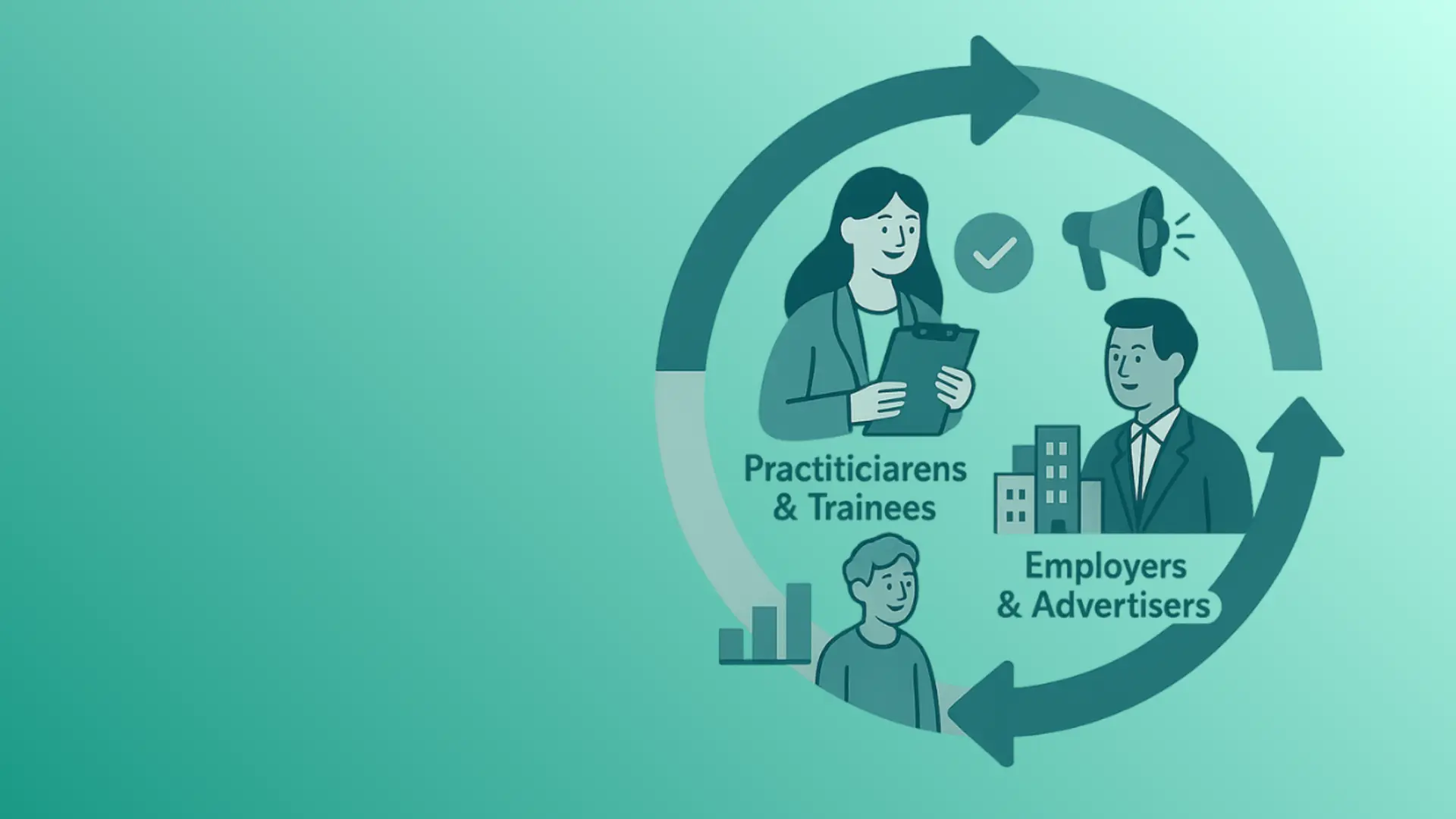

Harmonia operates in a two-sided marketplace: practitioner/trainee engagement drives employer/advertiser demand and recurring revenue across listings, subscriptions, credits and workforce intelligence tools.

Primary Users: Practitioners

300,000 registered professionals in the UK’s wider psychological and therapeutic workforce

Paying Customers: Employers & Advertisers

Over 10,000 non-NHS mental health employers, training and service organisations — and growing rapidly.

Secondary Users: Trainees

25,000 – 30,000 counselling, psychotherapy and psychology graduates enter the UK workforce pipeline each year.

Total Addressable Market

Estimated £45m–£60m per year spent on recruitment, job advertising and workforce marketing for the mental health sector.

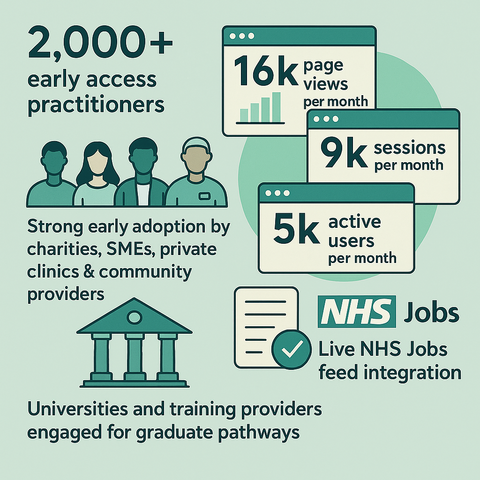

Early Market Validation

Without paid marketing or a dedicated sales team, Harmonia has built strong early traction and sector engagement through organic practitioner growth, partnerships and content. Our defensibility is underpinned by verified users, PSA-aligned checks, a specialist mental health taxonomy and real-time NHS workforce data integration — creating infrastructure that generalist platforms cannot replicate.

Business Model

Harmonia uses a modular pricing framework across:

- Job listings & employer subscriptions

- CV search credits

- Profile & listing enhancements

- CPD & training promotion

- Workforce intelligence products

This enables scalable revenue across different organisation sizes, from small charities to national training providers, while maintaining low churn and high lifetime value.

Commercial Roadmap

We are continuing to scale on our current platform while developing a bespoke next-generation platform ready for national launch in June 2026 (subject to funding). Our three-year roadmap transforms a fragmented system into a connected national mental health careers infrastructure, scaling from 5% to 25% market penetration by 2028.

2026 – Build & Launch

Platform delivery and commercial scale. Target: 5% market capture | £2.3m ARR

2027 – Partner & Scale

National partnerships and revenue expansion. Target: 10% market capture | £4.6m ARR

2028 – Own & Lead

UK leading mental health workforce platform. Target: 25% market capture | £11.5m ARR

Investment Offer

Raise: £1,000,000 for 20% equity

Valuation: £5m pre-money

Structure: Ordinary equity (SEIS/EIS compatible)

Completion target: 31 December 2025

Use of Funds

Investment is front-loaded to support the platform rebuild and core team, with measured increases in development and staffing costs across Years 2 and 3. As the platform matures and automates, costs stabilise relative to revenue, driving significant margin expansion and reinvestment into growth and market leadership.

- Staffing & Operations - £400K

- Platform Rebuild & Data Architecture - £200K

- Marketing & Growth - £250K

- Legal, Finance & Governance - £150K

Key Assumptions

These projections are based on a conservative £45.9m serviceable market and model revenue across employer subscriptions, job listings, CV search and CPD promotion.

Operating costs increase in Years 2 and 3 to support development, AI and verification infrastructure, and team growth, while remaining proportionally low relative to revenue scale.

- Avg. annual spend per customer: £800 – £5,000

- Market capture trajectory: 5% → 10% → 25%

- Modular product expansion across recruitment, training and workforce intelligence.

Financial Projection Summary

| Year | Market Capture | Revenue (ARR) | Spend | EBITDA |

|---|---|---|---|---|

| 2026 | 5% | £2.3m | £1m | £1.3m |

| 2027 | 10% | £4.6m | £800K | £3.8m |

| 2028 | 25% | £11.5m | £800K | £10.7m |

Returns & Exit

Harmonia is designed to deliver staged investor returns through early capital recovery, a defined acquisition strategy, and long-term value creation via infrastructure-led scaling:

- From the end of Year 3 (2028), Harmonia will allocate 20% of annual EBITDA to a structured investor share buyback programme. Based on projected EBITDA of £10.7m, this creates the potential for meaningful capital recovery within 24 months while allowing investors to retain equity upside.

- Our primary exit pathway is a strategic acquisition in Years 5–7 (2030–2032) at a targeted £70–90m valuation, supported by 5–7× revenue and 10–15× EBITDA multiples, delivering an estimated 5–7× return on invested capital for early shareholders.

- Alternatively, Harmonia’s proprietary modular platform model enables expansion across five workforce verticals — emotional health (current market) physical health, social health, nutritional health, and complementary health — increasing the addressable market from ~£50m to £300m+ and unlocking significantly higher long-term returns for early investors.

This isn't just an investment.

It's a stake in the future of the UK's mental health workforce.